Where It’s Easiest—and Hardest—to Find a Job Now

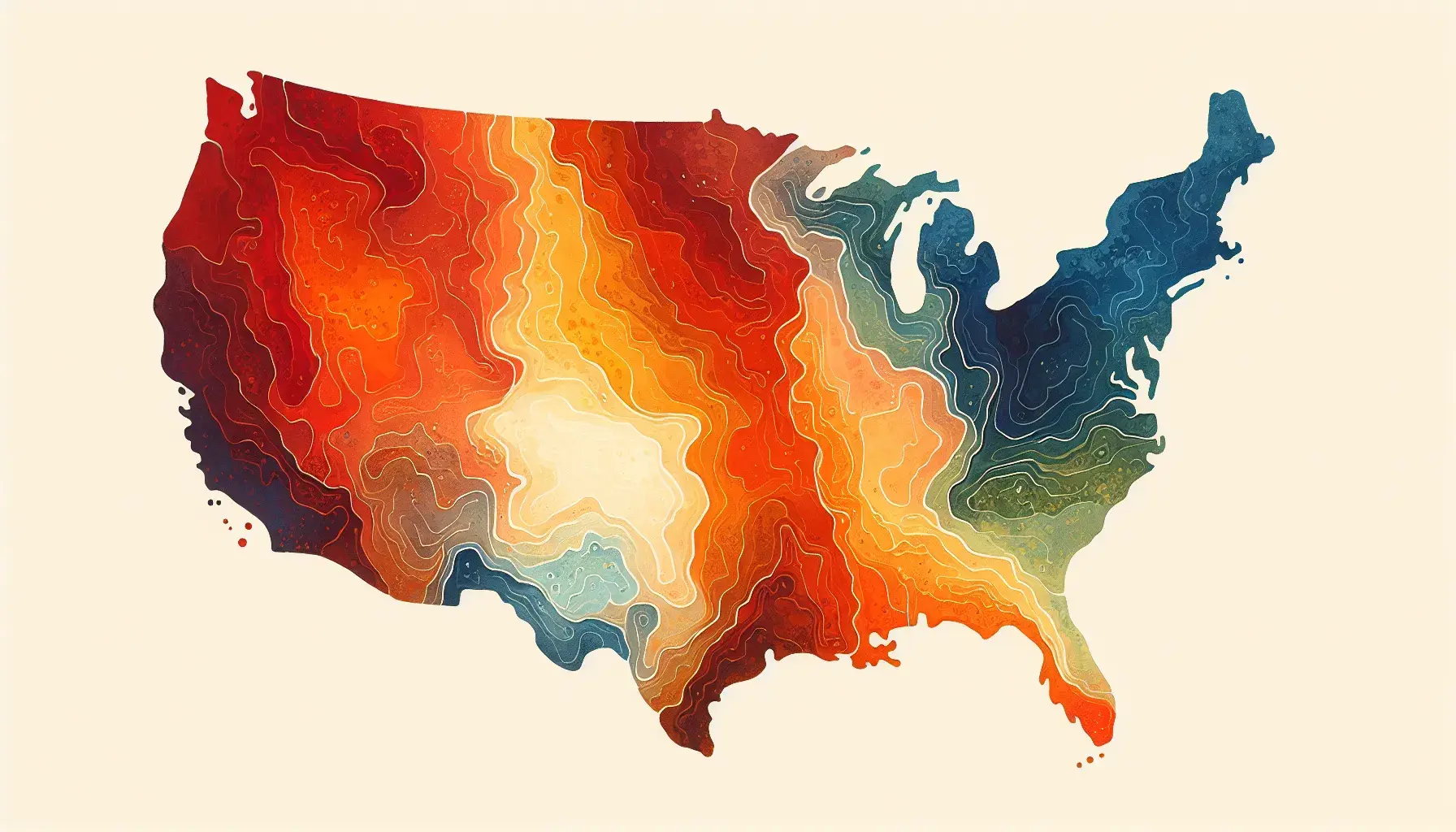

Plains and Upper Midwest states currently boast the lowest unemployment rates, while the District of Columbia and California sit at the top, underscoring how sharply the job hunt can vary by location even as the national labor market cools.

Where The Jobs Are

As of August 2025, state figures show the tightest job markets clustered in the northern Plains and parts of New England. South Dakota had the lowest jobless rate at 1.9%, a level that has kept the state among the steadiest labor markets in the country this year. Other low-rate states in recent months include Vermont, North Dakota, and New Hampshire, reflecting a mix of smaller labor pools, steady hiring in services and manufacturing, and relatively high labor force participation.

These patterns line up with what job seekers often experience on the ground: smaller states with diverse but stable employer bases, where openings and hiring plans have cooled less dramatically than in coastal hubs. In many of these markets, employers still report difficulty filling specialized roles even as overall demand eases.

Tougher Markets Now

The picture is different at the other end of the spectrum. The District of Columbia posted the highest unemployment rate in August at 6.0%, followed by California at 5.5%, with Nevada also elevated. Bigger, service-heavy economies have felt the slowdown more acutely as hiring in tech, media, and some government-related roles has softened and churn has faded.

For job seekers, that means more applications per opening and longer hiring timelines in those places. It does not mean opportunities have vanished—healthcare, education, and skilled trades continue to hire—but it raises the premium on targeted searches and flexibility on location or industry.

Why It Matters

Nationally, the supply–demand balance has cooled. Job openings were roughly flat in August at about 7.2 million, and the openings-to-unemployed ratio has hovered around one-to-one—meaning there are about as many job seekers as advertised roles. With openings near 7.2 million in August, the market now rewards candidates who can pivot across sectors or geographies and employers who streamline hiring and training.

Because conditions diverge so much by state, the “best” place to look depends on your field. Healthcare support, logistics, and advanced manufacturing remain relatively resilient; white-collar corporate functions are more competitive than a year ago.

What To Watch

Keep an eye on monthly BLS releases for state unemployment and job openings. If openings slip further while unemployment edges up, competition will intensify first in high-rate states and large metros. Conversely, any rebound in hiring is likely to show up earliest across the Plains and parts of New England, where unemployment is already low and employers face persistent staffing gaps.

Sources

- State Employment and Unemployment — August 2025 — U.S. Bureau of Labor Statistics (September 19, 2025)

- Job Openings and Labor Turnover — August 2025 — U.S. Bureau of Labor Statistics (September 30, 2025)

- Moderate US job openings, weak hiring underscore softening labor market — Reuters (September 30, 2025)

- The 10 best and 10 worst states for finding a job right now — Business Insider (November 1, 2025)

You May Also Like

These Related Stories

The 10 Best and 10 Worst States to Find a Job Now

The 10 Best and Worst States for Finding a Job Now

No Comments Yet

Let us know what you think