Apply for Westcliff University Today!

❤️ 100% Free Assistance + No Fee + Rewards!

We promise we won't spam your inbox with unnecessary emails. Privacy Policy

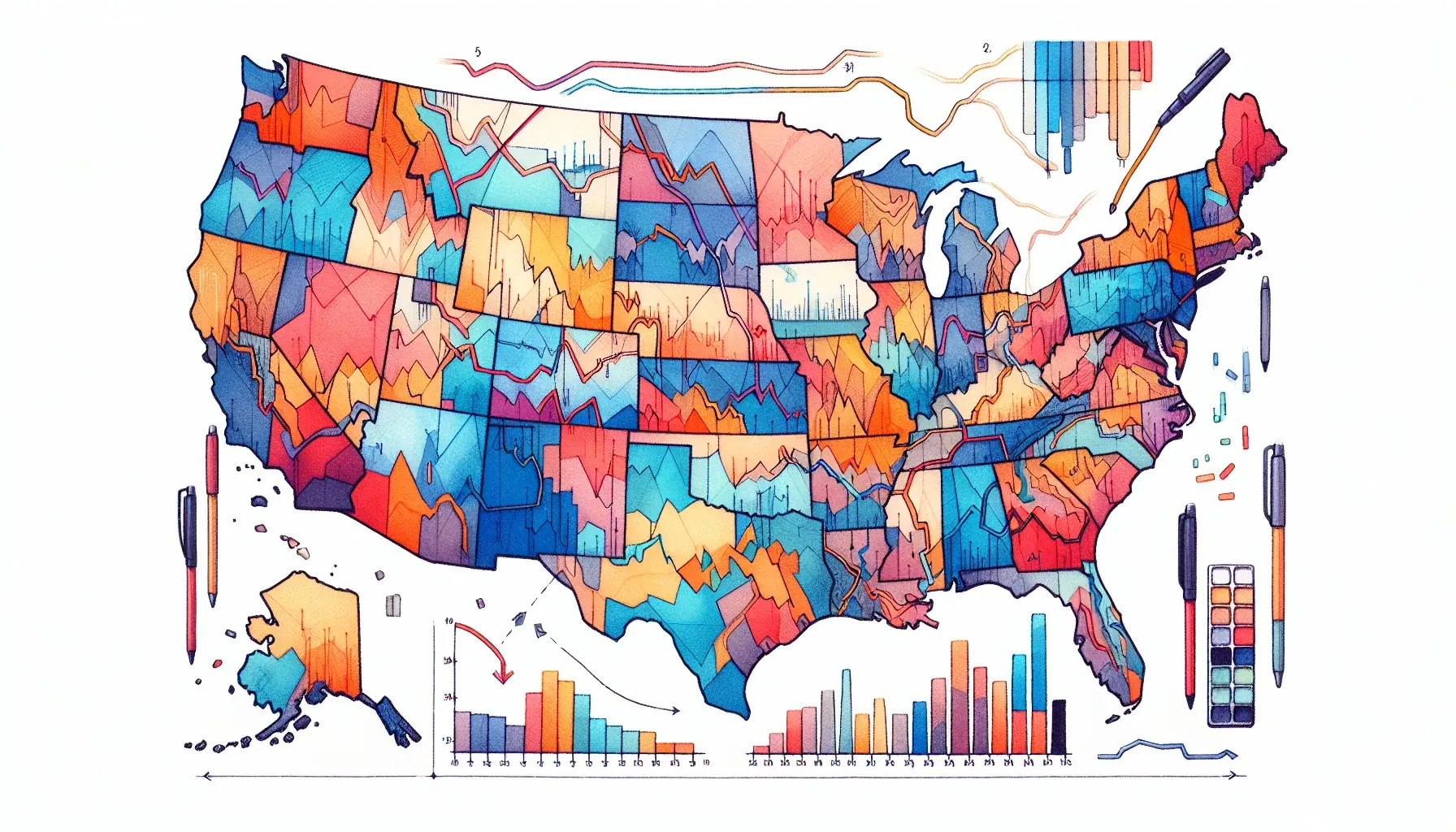

BLS data shows where finding a job is easiest—and where it’s hardest, with the latest state unemployment rates pointing to sharp regional differences as the labor market cools.

The Bureau of Labor Statistics’ August 2025 release puts South Dakota at the nation’s low with a 1.9% unemployment rate, while the District of Columbia tops the list at 6.0% (the highest overall, though not a state). California leads the states at 5.5%. Nationally, unemployment was 4.3% in August. These figures come from the BLS State Employment and Unemployment report published on September 19, 2025. (bls.gov)

Another signal of cooling: the openings-to-unemployed ratio slipped to about 0.98 in August, meaning there were slightly fewer job openings than job seekers—its weakest reading since 2021, according to BLS JOLTS data and contemporaneous Reuters analysis. The openings-to-unemployed ratio dipped to 0.98 in August. (bls.gov)

Based on unemployment rates (lower is better for job seekers), the ten most favorable state markets in August were: South Dakota (1.9%); North Dakota (2.5%); Vermont (2.5%); Hawaii (2.7%); Alabama (2.9%); Montana (2.9%); Nebraska (3.0%); New Hampshire (3.0%); Oklahoma (3.1%); and Wisconsin (3.1%). South Dakota’s 1.9% jobless rate is the nation’s lowest. (bls.gov)

Excluding the District of Columbia, which is not a state, the most challenging markets by unemployment rate were: California (5.5%); Nevada (5.3%); Michigan (5.2%); New Jersey (5.0%); Oregon (5.0%); Ohio (5.0%); Massachusetts (4.8%); Alaska (4.7%); Kentucky (4.7%); and Rhode Island (4.6%). California’s 5.5% is the highest among states. (bls.gov)

For job seekers, these rankings hint at how quickly applications may turn into offers, how hard employers are competing for talent, and where wage growth might have more momentum. They also reflect sector mixes: energy and agriculture support ultra-low joblessness in the Dakotas, while tech, entertainment, and retail-heavy states are still adjusting to a slower hiring pace. Nationwide, softer openings and steadier layoffs suggest employers are cautious but not panicked—conditions that reward targeted searches and flexibility on industry or location. (bls.gov)

These “best” and “worst” lists are derived from BLS seasonally adjusted state unemployment rates for August 2025. Other factors—like job openings by state, pay, cost of living, and industry mix—also shape search outcomes but are not captured in a single ranking. (bls.gov)

These Related Stories

No Comments Yet

Let us know what you think